By William Schomberg and Kate Holton

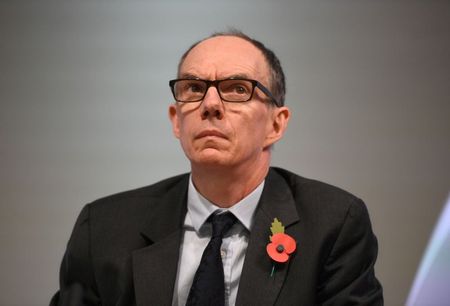

LONDON (Reuters) -Bank of England Deputy Governor Dave Ramsden said the BoE might start to think about reversing its huge monetary stimulus sooner than he previously expected due to growing inflation pressures as Britain’s economy bounces back from its COVID slump.

In a speech that suggested growing concerns at the top of the central bank about price pressures, Ramsden said British inflation might rise as high as 4% “for a period later this year” – double the BoE’s target – and the factors driving it up might take some time to ease off.

Official data published earlier on Wednesday showed British inflation hit 2.5% in the 12 months to June.

U.S. inflation has jumped even faster, reaching 5.4% in June, its highest in 13 years.

The Federal Reserve has said its top officials are poised to act if inflation risks build.

Ramsden said in a speech that Britain’s economy might regain its pre-pandemic size in the current July-September quarter, helped by huge fiscal support from finance minister Rishi Sunak as well as the BoE’s rock-bottom benchmark interest rate of 0.1% and its nearly 900 billion-pound bond-buying programme.

In May, the BoE said that the milestone of the economy exceeding its late-2019 size was only likely to be achieved in the last quarter of 2021.

Ramsden said the speed of the bounce-back from Britain’s 10% economic crash in 2020, and worries about spare capacity being too limited to absorb price pressures, meant the BoE might be getting closer to its conditions for scaling back its stimulus.

The central bank’s Monetary Policy Committee has said it does not intend to tighten monetary policy at least until there is clear evidence of significant progress in eliminating spare capacity and achieving the 2% inflation target sustainably.

“Based on the rapid pace of developments since we published our May forecasts and the shift in the balance of risks, I can envisage those conditions for considering tightening being met somewhat sooner than I had previously expected,” Ramsden told the Strand Group, a research and teaching group.

“That reflects my current assessment that on balance I put more weight on my inflationary than my disinflationary scenario,” he said.

Earlier on Wednesday, financial markets were pricing in a first rise in BoE interest rates to 0.25% by August 2022.

While backing the BoE’s view that the rise in inflation would probably prove temporary, Ramsden said it was “important to stress here that ‘transitory’ does not mean ‘here today, gone tomorrow’.”

He acknowledged that downside risks to Britain’s economy from the spread of COVID – which has recently accelerated again in the country – remained “clear and present” and it was too early to rule out a possible weakening of inflation pressures caused by a revival of the pandemic.

But it was also possible that inflation could be more persistent, he said, if the next easing of social-distancing rules further boosts confidence among consumers and businesses while the post-lockdown bottlenecks that have driven up prices continue.

Since the pandemic, the only one of the MPC’s nine members to vote in favour of scaling back the BoE’s 895-billion-pound bond-buying programme has been Andy Haldane, the central bank’s chief economist, who has since stepped down.

The temporarily eight-member MPC is due to deliver its latest assessment of the economy and its monetary policy decisions on Aug. 5.

Earlier on Wednesday, another BoE deputy governor, Jon Cunliffe, said the recent jump in British inflation was a bump on the road as the economy reopened from lockdowns, and the BoE would look at its likely persistence next month.

(Writing by William Schomberg; Editing by Kate Holton, Alistair Bell and Toby Chopra)