By Stella Qiu

SYDNEY (Reuters) -Asian shares sputtered on Friday while the dollar rebounded from one-year lows as investors were cautious ahead of a speech by the world’s most powerful central banker with markets looking for confirmation U.S. rate cuts would start in September.

The Japanese yen gained 0.4% to 145.63 per dollar after Bank of Japan Kazuo Ueda flagged an willingness to raise interest rates if the economy and inflation turn out as forecast.

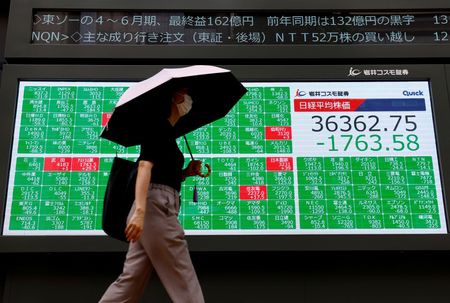

The Nikkei sold off but turned 0.4% higher in the afternoon to hit a fresh three-week high as investors decided Ueda was not as hawkish as feared. Domestic yields rose 3 basis points in modest reactions. [.T]

Europe is set for a subdued open with EUROSTOXX 50 futures flat and FTSE futures up 0.4%. S&P futures and Nasdaq futures rose 0.3% and 0.6% respectively.

Data out early in the day showed Japan’s core inflation accelerated for a third straight month, but a slowdown in demand-drive price gains suggest no urgency for any immediate rate hikes.

Krishna Bhimavarapu, APAC economist at State Street Global Advisors, expects the stronger yen and reintroduction of energy subsidies to slow inflation in the near-term.

“If the data evolves as we expect, it could mean that the next BOJ hike may not come until December as fears of rapid inflation ease to an extent.”

Traders see very little chance that the BOJ could hike rates in October after the recent sell-off, but a move in December is priced at 70%.

Guided by higher Wall Street futures, MSCI’s broadest index of Asia-Pacific shares outside Japan trimmed earlier losses to be just down 0.1%. It was headed for a weekly gain of 1%.

China’s blue chips gained 0.3%, although Hong Kong’s Hang Seng fell 0.3% while South Korea edged up 0.1%.

Overnight, Wall Street fell as sentiment turned cautious ahead of the Federal Reserve Chair Jerome Powell’s speech in Jackson Hole. Three Fed speakers on Thursday alluded to a rate cut in September, with them voicing support for a “slow and methodical” approach.

Taken together with surveys showing the U.S. economy still growing at a healthy pace, markets slightly pared back the chance of an outsized half-point cut in September to 24%, from 38% a day earlier. A quarter-point reduction is fully priced in.

Robert Carnell, regional head of research, Asia-Pacific, at ING, noted there was still scope for Powell’s speech to excite or disappoint markets given the market pricing, but much will depend on data.

“As any decision that deviates from market pricing will rest on as yet unknown data, it is hard to see how Powell can commit to much beyond some easing of some sort in September, and even then, only barring data accidents,” said Carnell.

Treasury yields slipped a little on Friday, having gained overnight for the first time in five sessions. Ten-year yields fell 2 basis points to 3.8445% in Asia while two-year yields also dropped 2 bps to 3.9934%.

Declining yields pressured the dollar to one-year lows, although it did get some respite from selling pressure overnight. The euro came off its one-year high to $1.1126, with major resistance seen at $1.1139.

Commodities looked set to end the week lower.

Brent crude futures were almost flat at $77.28 a barrel, although they are down more than 3% for the week as swelling U.S. crude stocks and a weakening demand outlook in China have raised pessimism. [O/R]

Gold prices are up 0.4% to $2,494.84 an ounce, recharging towards its record high of $2,531.6 hit just on Tuesday.

(Reporting by Stella QiuEditing by Shri Navaratnam and Kim Coghill)