By Patrick Werr

CAIRO (Reuters) – Egypt’s economy will grow 5.1% in the fiscal year that ends in June 2022, but accelerate to 5.5% in each of the following two years as tourism continues to rebound and the effects of the coronavirus pandemic wane, a Reuters poll showed.

The central bank said last month economic growth surged to 7.7% in the final quarter of the last fiscal year, indicating growth of 3.3% for the entirety of 2020/21, up from a previous full fiscal-year estimate of 2.8%.

Economists in a July poll predicted economic growth would be 5.0% for the year to next June.

“We expect consumption growth to pick up from a low base post-COVID and public investment to remain strong this year,” Allen Sandeep of Naeem Brokerage said.

“What will be critical to see is if this growth is sustained in 2022/23, by when the pandemic effects should hopefully subside substantially.”

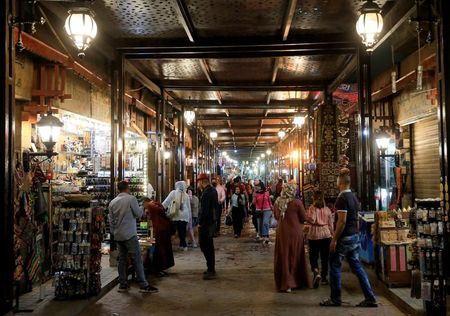

Tourism has been gradually recovering from COVID travel restrictions put in place in March 2020.

Tourism revenue plummeted to $4.9 billion in 2020/21 from $9.9 billion a year earlier. But in the April to June quarter it bounced back to $1.75 billion from a low of $305 million in the same quarter of 2020, according to central bank data.

In the latest Reuters poll, economists expected annual urban consumer price inflation to climb to 6.0% in 2021/22, then picking up even further to 6.4% in 2022/23 and 7.0% in 2023/24, still within the central bank’s target range of 5% to 9%.

Egypt’s annual inflation rose to 6.6% year-on-year in September, its highest in 20 months, from 5.7% in August, mainly due to rising food prices, the state statistics agency CAPMAS said this month.

The currency will weaken to 15.81 Egyptian pounds per dollar by the end of 2021, to 16.25 by the end of 2022 and to 17.24 by the end of 2023, the Oct. 8-20 poll of 22 economists showed.

The central bank is expected to leave its overnight lending rate unchanged at 9.25% throughout 2021/22 and 2022/23, then increase it to 10.25% by the end of June 2024, the poll found.

“We believe Egypt’s sizeable CA (current account) deficit explains the central bank’s reluctance to cut interest rates,” causing a strong increase in imports and income outflows, RenCap’s Yvonne Mhango wrote in a note.

(For other stories from the Reuters global long-term economic outlook polls package:)

(Reporting by Patrick Werr; Polling by Md Manzer Hussain in Bengaluru; Editing by Alison Williams)