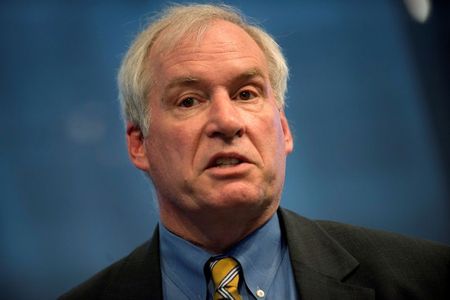

(Reuters) – A buildup of financial stability risks linked to a low interest rate environment could lead to another downturn that interrupts the labor market recovery and impedes a return to maximum employment, Boston Federal Reserve Bank President Eric Rosengren said on Friday.

Policymakers need to monitor rapidly rising home prices, the growing use of stablecoins and reform money market funds to minimize the risks of a financial crisis down the line, Rosengren said during a virtual event organized by the Philadelphia Fed and the Official Monetary and Financial Institutions Forum.

(Reporting by Jonnelle Marte; Editing by Chris Reese)