By Jonnelle Marte

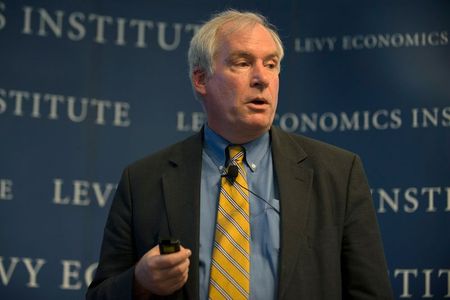

(Reuters) -It is possible the U.S. economy could reach the conditions on maximum employment and inflation that would merit an interest rate increase next year, but it will be important to watch the data, Boston Federal Reserve Bank President Eric Rosengren said on Friday.

Rosengren declined to provide his projection for interest rates, stressing the Fed’s policy will depend on economic data.

“But it wouldn’t surprise me based on the current projections of what we’re seeing in the data that that criteria could be met as soon as the end of next year,” he said during an interview with Yahoo Finance.

Rosengren said he expects the U.S. economy to grow by about 7% this year, and for inflation to be slightly above 2% next year. While there is currently still slack in the labor market, the U.S. economy could approach full employment by the end of this year or the beginning of next year, he said.

Fed officials agreed at last week’s policy meeting to leave interest rates near zero and to continue purchasing $120 billion a month in Treasury securities and mortgage-backed securities until there is “substantial further progress” toward the central bank’s goals of maximum employment and 2% average inflation.

Rosengren said he thinks the “substantial further progress” goal has been met for inflation, which he expects will slow down going into next year as supply imbalances are resolved. He said the labor market may reach the Fed’s standard for tapering asset purchases before the start of next year.

“A lot depends on exactly what happens with the economy over the course of the summer and into the fall,” he said.

When the Fed starts to taper, it could consider trimming the purchases of Treasury securities and mortgage-backed securities by the same amount, which would end the purchases of mortgage backed securities sooner than Treasury securities, he said. But those details have not yet been finalized, Rosengren said.

(Reporting by Jonnelle MarteEditing by Chris Reese and Peter Graff)